| home |

| faq |

| sitemap |

| contact |

What

is this site about?

Around

1998 I discovered that it was possible to create an artificial

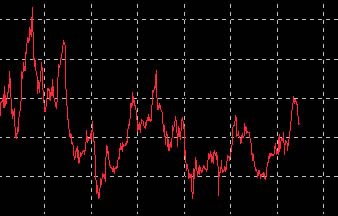

intelligence (AI) that could find patterns within a time-series. A

time-series looks like the following graph:

If this AI could learn about the patterns in the chaotic signal then it might be able to generalize its future course. That is, it might know about how the pattern continues into the future. So right away I noticed an obvious application: to try and apply this to the stock market. Check here to see the latest results. Or to see an example of the output, check here.

As it turns out this AI can be used to predict other signals, not just within the stock market. A lot of these applications could relate to finding patterns in a variety of noisy chaotic signals like the one above. For example: if a company is producing aluminum parts, say aluminum cans, or aluminum car parts, and they purchase large amounts of aluminum - they may have an interest in purchasing their bulk aluminum at the lowest price. If the price of aluminum fluctuates in a chaotic fashion then the AI could predict when its price would fall or when it would rise.

This is just one example of the numerous possibilities available for this technology. A potential user can probably imagine all sorts of advantages that could be gained by such a prediction. We could not possibly conceive of what all of those specific applications might be, but we would be happy to hear about it..... email us.

So ... five years and 20,000+ lines of code later ...the AI is at a point where it can be used in the above manner.

We have setup this site to attract potential users in an effort to apply and sell the AI as a service.

How can you find patterns within chaotic signals, when chaos itself is dynamic, random, and unpredictable?

Actually, in physics the term "chaos" is used to define a specific type of process. Which at first may appear to be chaotic in nature, but it nonetheless contains some repeatable patterns that are hard to first discern. In my testing of this AI I discovered that there are apparently three types of signals (when I mean signals I am referring to the time-series signals such as the price history for a single stock). These types of signals can be classified as either being: chaotic, unpredictable, or a hybrid of chaotic and unpredictable, which I call semi-chaotic. These three types of signals have an increasing level of randomness. The chaotic having the least, the unpredictable having the most, and the semi have it somewhere in between.

The signals that I am interested in finding are the chaotic signals because they have some underlying pattern, which I wish to discover. The "unpredictable" signals are simply just that: "unpredictable". I can do nothing with these since their randomness is so high that the AI cannot find a pattern, that is, it cannot find a solution to the problem. This happens to occur in the majority of the signals ... and there is nothing I can do about them except to ignore them. The signals I am most interested in are these "chaotic" signals because they contain some pattern that the AI is able to find, and therefore these are the predictable ones.

What are the indicators or factors that your program uses (or considers)

in order to predict the market price of an item for example, aluminum?

This is most difficult to answer since it requires a deep understanding of time-series analysis. This level of electrical engineering is taught at the graduate level, and I found it very beautiful but filled with extremely long derivations and wild conclusions. But one of the most interesting conclusions we get from this theory is that all of the factors that went into bending the curvature of that historical data is contained within the same curvature of the signal. So, the problem becomes how do we extract that information from the historical curvature of the signal ... this becomes the job of the AI.

How can the system analyze a signal if it cannot fully comprehend what it is observing, as a human might understand it?

The system may not be able to fully understand what it is observing but, an interesting property of the AI is that it can be designed so that it is very robust, so that it can work on a signal in a generalized way. The AI does not need to know what "kind" of signal it is observing, it is only mathematically searching for patterns within the curvature of the signal. It will not know that it is looking at the price of aluminum, or the price of an IBM stock, etc. Another example of this could be; if you imagine your eyes looking at something, the signals of that image travel through the optic nerve to your brain. The optic nerves will not know what that thing is that you are observing. It simply transfers and processes that information. Of course, what your mind does with that information is beyond anyone's guess. But the AI designed here only needs to find patterns. It does not need to know or understand what it is observing. That type of understanding is left for the next level of artificial intelligence.